Financial Modeling Foundations (LinkedIn Learning)

https://www.linkedin.com/learning/financial-modeling-foundations

Financial models should:

- Be simple

- Focus on key cash flow drivers

- Convey assumptions and conclusions

- Help evaluate risks through:

- Sensitivity analysis

- Break-even analysis

- Scenario analysis

Types of models

Comparison

Deterministic (known inputs, precise outputs) vs stochastic (probability-based, Monte Carlo simulations; more complex)

| Three Statement Model | DCF Model | Buyout Model | |

|---|---|---|---|

| Valuation from model | Present value of discounted free cash flow or multiples | lnvestment decision and implied value depends on equity IRR versus market hurdle rate | Entry multiple and acquisition premium depends on equity IRR and hurdle rate |

| Base case risk measurement | Weighted average cost of capital, multiples, terminal growth | Debt capacity, debt terms | Senior and subordinated debt financing and exit multiple |

| Traditional risk assessment from equity perspective | Sensitivity analysis and scenario analysis of DCF and multiple value | Sensitivity analysis and scenario analysis of equity IRR | Sensitivity analysis and scenario analysis of equity IRR |

| Tradition risk assessment from debt perspective | Break-even analysis to determine ability to refinance and maintain credit rating | Break-even analysis to determine at what point cash flow can’t service debt | Break-even analysis to determine IRR on senior and subordinated debt |

| Monte Carlo analysis with model | Probability distribution of EPS and DCF valuation | Probability distribution of equity IRR and probability of DSCR below 1.0 | Probability distribution of equity IRR, senior IRR and junior IRR |

| lnformation base | Historical financial statements, analysis of value drivers | Contracts and analysis of commodity prices and other value drivers | Historical financial statements, analysis of value drivers, transaction terms |

| Model starting point | Historic balance sheet | Sources and uses analysis | Sources and uses and pro-forma balance sheet |

| Cash flow process | Net cash flow after dividends that result in changes in short-term debt or surplus cash | Cash flow waterfall that ultimately measure dividends paid to equity | Cash flow waterfall that ends in dividends paid to equity |

| Debt analysis | New and existing | New debt issues from transaction | New debt issues from transaction |

| Model termination | Arbitrary terminal period | End of project life | Transaction holding period |

| Model output | DCF valuation, EPS projection, implied P/E, credit quality | Equity IRR, project IRR, DSCR | Equity and debt IRRs, debt/EBlTDA |

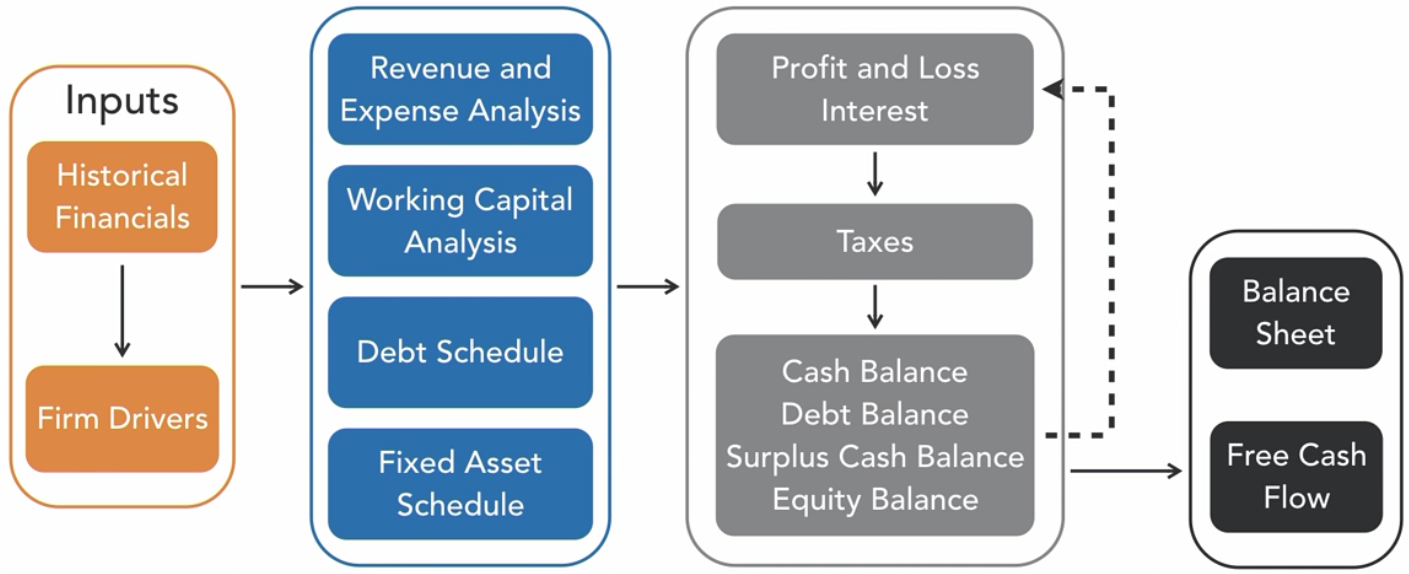

Corporate financial model (three-statement model)

02-0X, 03-0X files

Process

- Gather: historic financial statements

- Change: arrangement of financial statements

- Compute: ratios from historic financial statements to develop mechanical assumptions

- Develop: revenue, expense, and capital expenditures by working through value drivers

- Work through: income statement, cash flow statement, balance sheet to check, only for forecast years

- Valuation: sensitivity analysis and presentation

Project finance model (discounted cash flow model)

04-0X files

Need: Starting cash flow, growth rates (and change over time), discount rates (relates to risk)(often WACC is used)

Present Value: =PV(discount rate, number of periods, dividends, free cash flow (but -ve), 0)

Dividend Discount Model (DDM) Terminal Value: Latest value * (1 + future growth (%)) / (discount rate (%) - future growth (%)) → then calculate PV

Multiples Terminal Value: Latest EBITDA * EBITDA Multiple

Total Value of Firm = Sum of FCFs + TV

Discounted Cash Flow (DCF) Valuation = =NPV()/# shares

Internal rate of return (IRR): =IRR(CFs) → If IRR > discount rate/WACC, invest. Higher WACC = lower IRR.

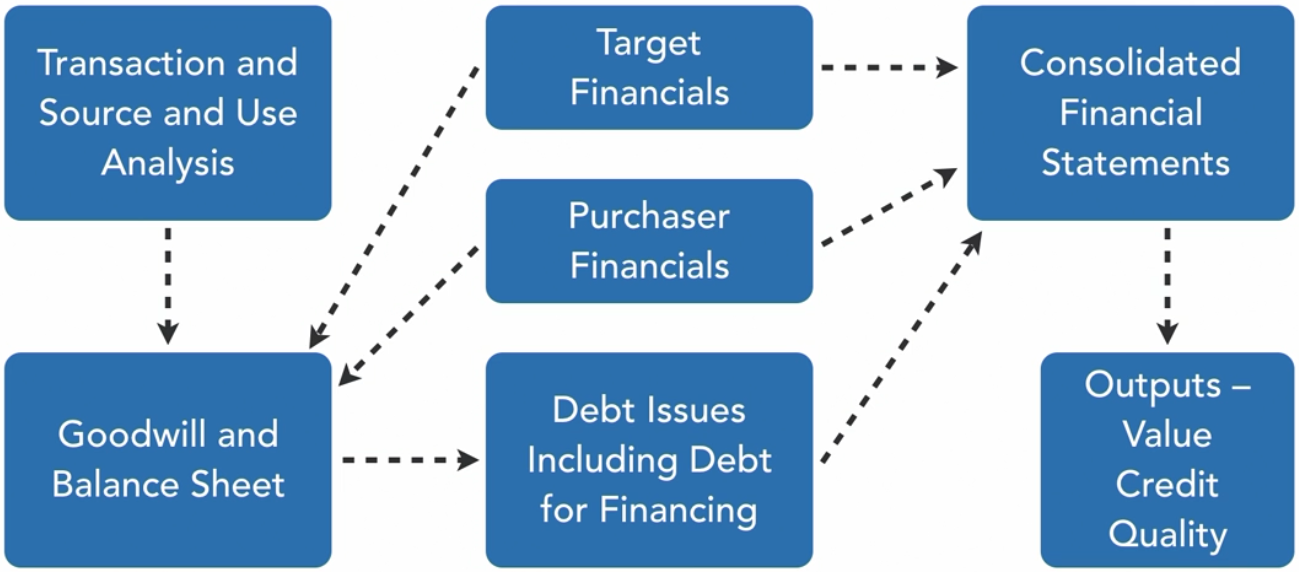

Leveraged buyout model (M&A model) and integrated consolidation model

Often includes DCF model and 3S model

Model uses

Corporate finance

Investment

Other notes

Hints and tips

- Don’t use long formulae

- Do keep inputs together

- Avoid circular references (check Formulas > Error Checking; also check Formulas > Trace in Excel) → potentially use fixed values instead of formulae (add comment or change colour so as not to lose track)

- Blue = hard-coded value, black = formula, green = link to other sheet

- Corkscrews: output of one as input of another, and repeat (e.g. year 1 end cash = year 2 start cash)

- Waterfall: input flowing through multiple calculations to final output (e.g. revenues → operating income → net income → total cash from operations → net cash)

- Toggles: e.g. scenario cell: best case, normal case, worst case →

=IF(scenario=1,100,IF(scenario=2,50,IF(scenario=3,10))) - Sensitivity analysis charts: Terminal Growth Rate or Terminal EBITDA Multiple vs Discount Rate; IRR vs Exit Multiple or % Debt

- FRED (Federal Reserve Economic Data) Excel Add-In → Interest rates, corporate bond yields, …

Growth rate analyses

Year-Over-Year Growth Rate: CAGR → most basic form, doesn’t change annually so can’t consider predicted recessions etc

Top-Down Analysis: Company market share (TAM: total addressable market) → Geographic segment → Product → Customer unit → Revenue

Top Down Growth Rate (%) = ((1 + Total Market Sales Growth (%)) * (1 + Market Share Growth (%)) * (1 + Order Value Growth (%)) - 1

Bottom-Up Analysis: Website traffic → Conversion rate → Order value → Revenue

Bottom Up Growth Rate (%) = ((1 + Prospect Traffic Growth (%)) * (1 + Conversation Rate Growth (%)) * (1 + Price Growth (%)) - 1

Regression Analysis: Relationships between factors e.g. marketing spend