Corporate Finance Fundamentals (CFI)

https://corporatefinanceinstitute.com/course/corporate-finance-fundamentals/

https://www.credential.net/78615569

Introduction

Primary market

- Buy side: institutions/investments

- Sell side: investment banks

- Corporations: exchange bonds/shares for capital

Secondary market

- Fund managers buy/sell at stock exchange through investment banks

Capital Investment

Creates economic benefit greater than one year

Increase assets

Calculations

NPV = FV/(1+r)^n

Note: Excel =NPV is different from manual calculation → “Excel NPV formula assumes that the first time period is 1 and not 0. So, if your first cash flow occurs at the beginning of the first period (i.e. 0 period), the first value must be added to the NPV result, not included in the values arguments (or use XNPV).”

Terminal Value (growing perpetuity formula) = FCF*(1+g)/CoC-g → CoC = discount rate = risk-free rate → risk go up, value down

Terminal Value (using metrics) = Metric (Earnings, EBITDA, Revenue) * Multiple

Enterprise value = Equity value (= share price * shares) + debt - cash = NPV of business

IRR: equivalent to compound annual growth rate, can be used to set NPV of CFs to equal 0

M&As

M&A process:

- Strategy

- Criteria

- Search

- Approach

- Evaluation and valuation

- Negotiation

- Due diligence

- Contracts

- Financing

- Integration

Strategic buyers (expansion or operational synergies) or financial buyers (private equity, professional investor, high leverage)

Standalone value + [hard synergies (cost savings) + soft synergies (revenue enhancements) - transation costs] = standalone value + net synergies = price paid (consideration) + value created

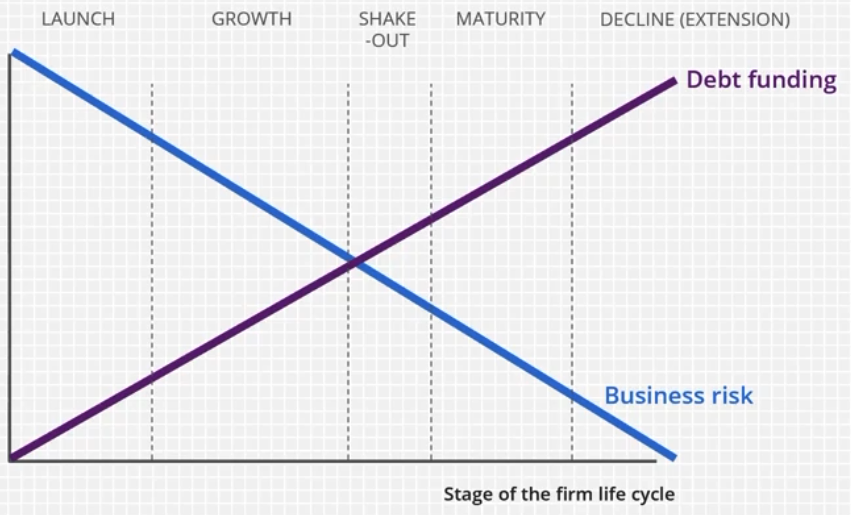

Capital financing

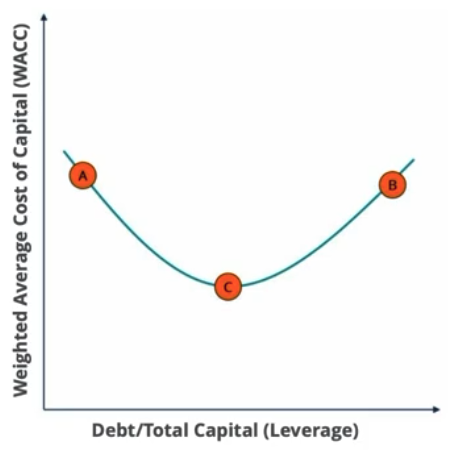

Capital structure = debt vs equity (high leverage = high debt:equity)(equity + debt = assets)

WACC (%) = cost of equity * % equity + cost of debt * % net debt

Risk and returns, high → low: Equity (common shares > preferred shares > shareholder loans) > subordinated debt > senior debt

Equity

Sources: private (founders, PE, VC, LBO) vs public (institutional, retail)

Shareholder loans pay interest but no dividend; preferred and common shares pay dividends, preferred has priority

Debt

Benefits: for corporation: can lower CoC, avoid equity dilution; for investor: can increase return

Assessing debt capacity: EBITDA, volatility, ratios (debt:X, X:EBITDA), …

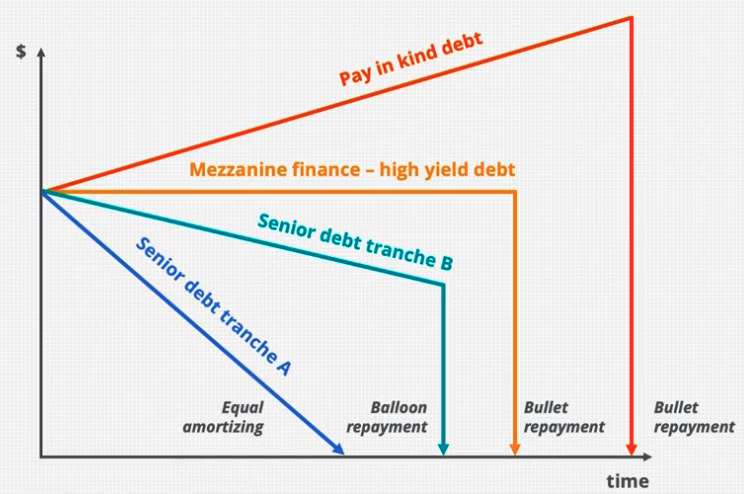

Senior debt: revolver, term loans → usually 2-3x EBITDA, required 2x interest coverage

Subordinated debt: bonds, mezz, notes → some dilute equity

Credit ratings: investment grade: Baa3/BBB-/BBB (low) and above; high yield/junk bonds: Ba1, BB+, BB (high) and below

Comparison

| Equity | Debt | |

|---|---|---|

| Interest / mandatory fixed payments | No | Yes (typically) |

| Repayments / maturity | No | Yes |

| Ownership | Yes | No dilution |

| Control | Degree of control, voting rights (typically) | Requires covenants and financial performance metrics that must be met |

| CoC | Higher | Lower |

| RoR | Higher (dividends + capital appreciation) | Lower |

| Claim on firm’s assets if liquidation | Last | First |

| Operational flexibility | Maximum | Restrictions |

| Can push a firm into bankruptcy |

Underwriting

Bank raises capital for corporation as debt/equity securities

Firm commitment (underwriter buys and sells) vs best efforts (underwriter sells on behalf of corporation)

IPO: usually with some discount to ensure after-IPO trading and reduce the risk of equity overhang

Dividends and return of capital

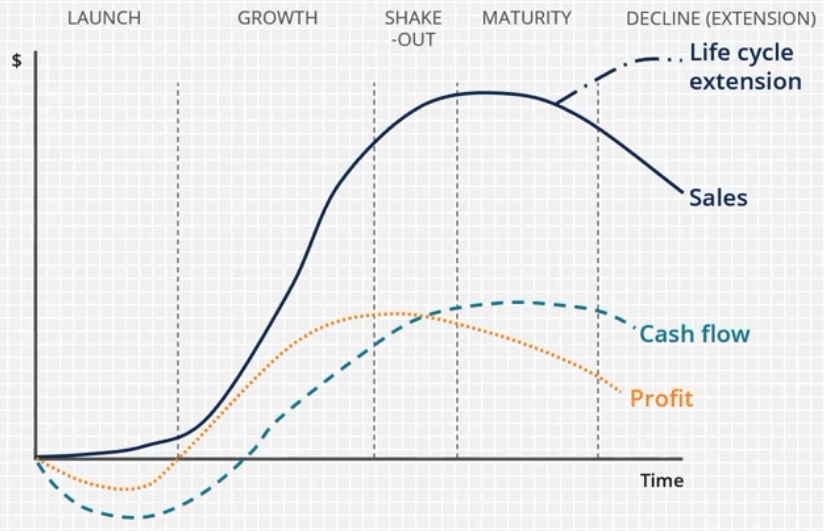

Earnings: distribute vs retain → e.g. if CoC > IRR, repurchase shares or pay dividend, else retain and reinvest

Share buyback increasees EPS; paying dividend (if regular) increases yield